To ensure uptime and stability of the platform, we scheduled some maintenances on our infrastructure:

- On 25th of October between 10am – 11am

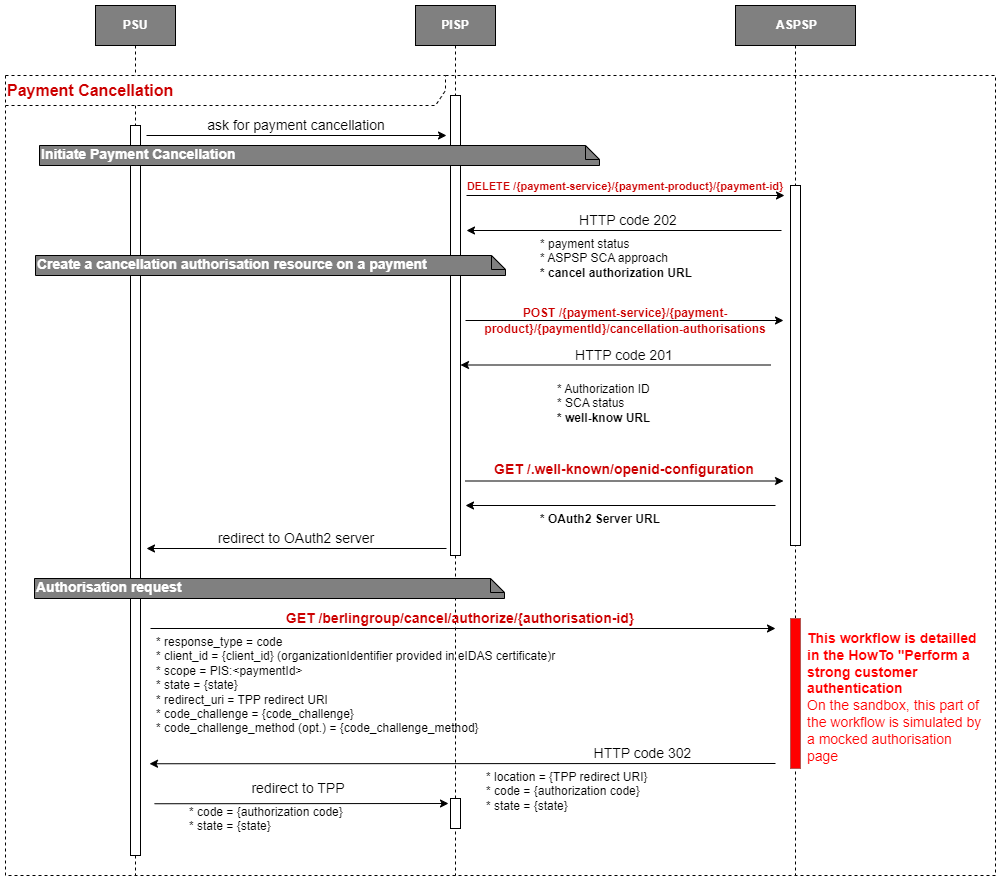

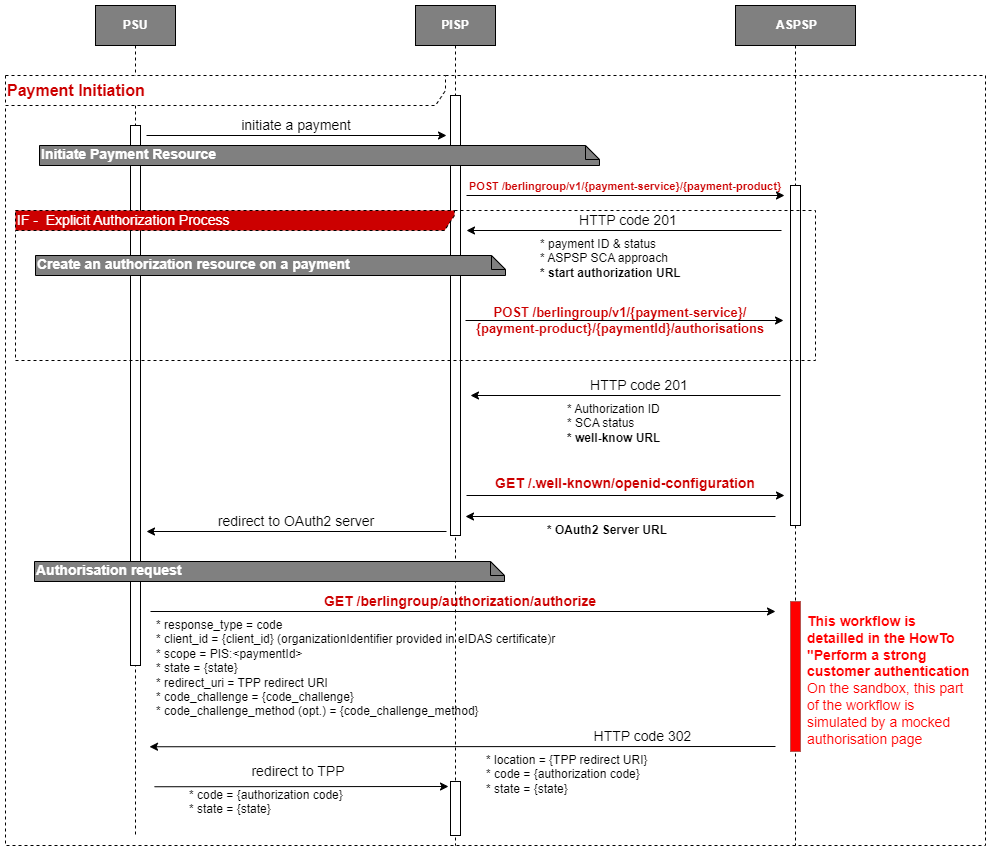

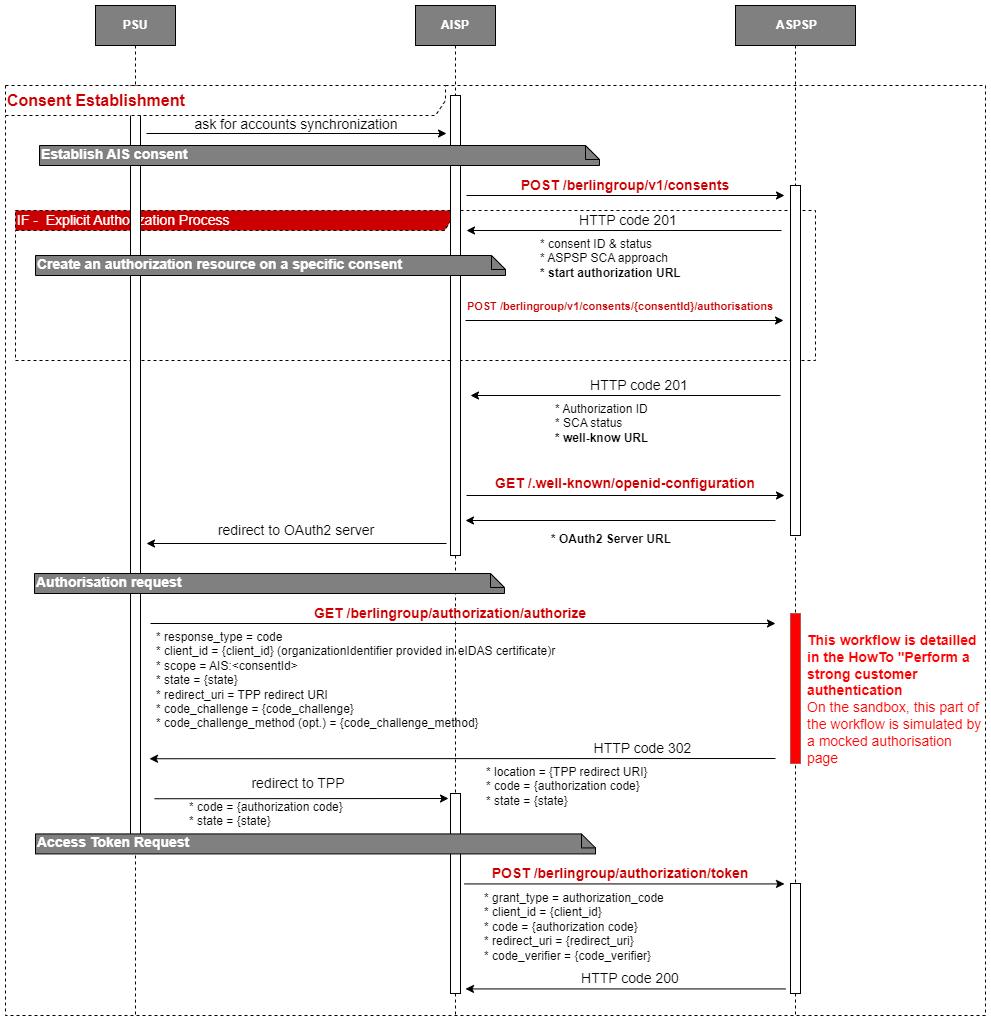

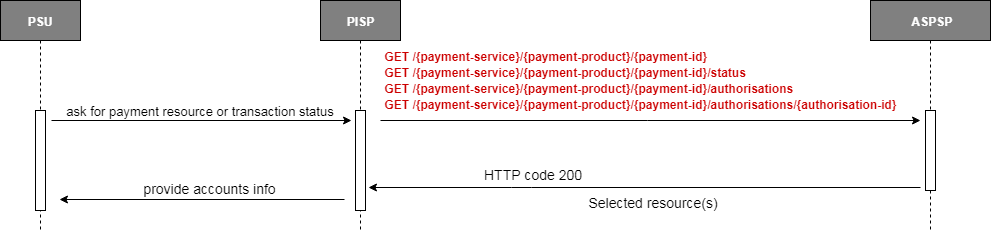

05 - Manage payments information and status

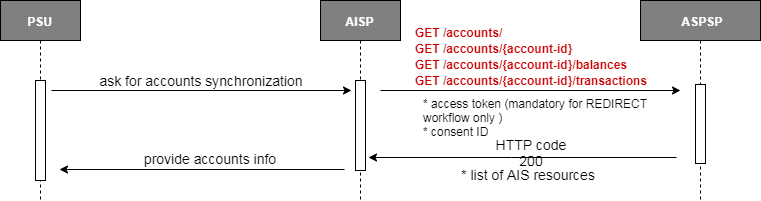

To access a payment resource or the status of a related transaction several endpoints are available. The APIs are listed below. All specifications of these APIs can be found on the API page of this developer portal.

Note that to access payment resources, you don't need to provide an access token in requests if the payment has been initiated through a redirect Oauth2 workflow

The TPP can retrieve the payment resource using the API above.

The TPP can retrieve the transaction status of a given payment using the API above.

TPP can retrieve the list of all the authorizations linked to the payment resource using the API above.

The TPP can retrieve the status of an authorization linked to the consent resource using the API above.

For specific BerlinGroup Implementation on the Payment Initiation Service, please refer to specific implementation How To.